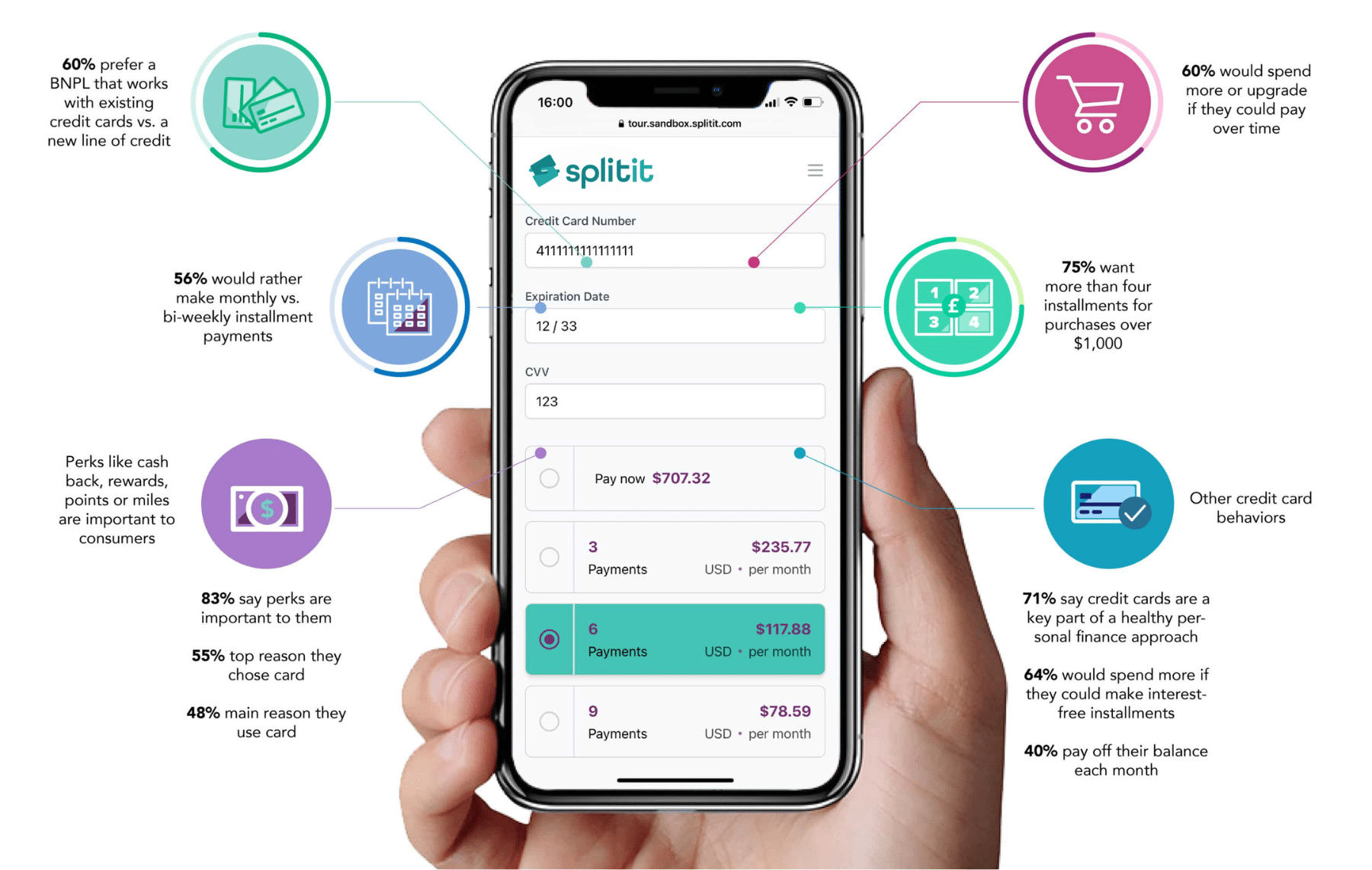

What consumers really want in a BNPL provider

Installment payments – or buy now, pay later (BNPL) plans – have exploded in popularity the last few years. What’s not to love? Consumers get to buy what they want and pay over time with interest-free installments. But what consumers may not know is that those convenient payment options at checkout are actually new loans or that repayment plans every two weeks can become a burden.